Are you are type of person who is confused when to invest in Equity more and when to reduce it. Do you tend to make impulsive decision of suddenly putting more money in Equity funds when market goes up or down without any discipline, Balanced advantage fund category could be your best bet to let that decision be handled professionally. Let Betaal review this Balanced Advantage fund for you.

Vikram went back to the graveyard and pulled Betaal down. Put him on to his shoulder. As he started walking back, Betaal said, “Now I will tell you about Balanced Advantage Mutual Funds and then ask a question. You must tell me the answer otherwise I will break your head. But if you speak I will fly back to the tree.” Vikramaditya agreed.

Betaal started with his story.

What are Balanced Advantage mutual funds

Betaal started explaining Vikram, “Balanced Advantage Mutual Fund is category of Hybrid Mutual fund which invests in Equity (stocks) and Debt (Fixed Income). These funds can dynamically change percentage of Equity and Debt allocation. So these funds are also called as Dynamic Asset Allocation Funds.

In normal Equity Hybrid Funds, equity allocation is more or less static – in range of 65 to say 75%. However in balanced advantage case, equity can go down even to low of 35% or even as high of 90%.

Based on market conditions and fund philosophy, this allocation keeps changing regularly. Idea here is to take larger bets on assets (Equity or Debt) as per market conditions.

How does Balanced Advantage Mutual Funds work

Betaal continued, “Vikram, there are broadly two types of strategies that are currently followed by these funds. Any Balanced Advantage Fund will take one of the routes.

First approach is classical approach – Buy low, Sell High. So when stock market valuation is low, fund will have higher exposure to equity. When markets are running high, they will reduce their equity exposure. This way there is less impact of stock market crash as equity allocation during bull market will be low.

Most of Balanced Advantage funds in India follow this approach.

Second approach is momentum approach – Buy stocks when momentum or market sentiment is good. When markets are running high, buy more of equity and get advantage of bull run. When tide turns and if market sentiment turns red, reduce equity allocation.

Edelweiss Balanced Advantage Fund follows this momentum approach.”

What are risks in Balanced Advantage Mutual Funds

Betaal whispered in Vikram’s ears, “Vikram, I know what you are thinking. Idea looks great. Just invest in right asset at right time.

This sounds great for everyone. This way we can beat stock market returns as we can move to debt asset when equity does poorly.

No. That is not the case. It is open secrete that no one can predict when market will rise, pick and crash. So over long run, pure equity funds have beaten these funds handsomely.

It is like this Vikram, not all people have stomach for market crash and volatility of equity. There is significant section of people in India who want to participate in equity but are fearful due to its volatility.

Balanced Advantage Funds are for this type of people who want to participate in equity but want some option that is less volatile.”

Returns of Balanced Advantage Mutual Funds

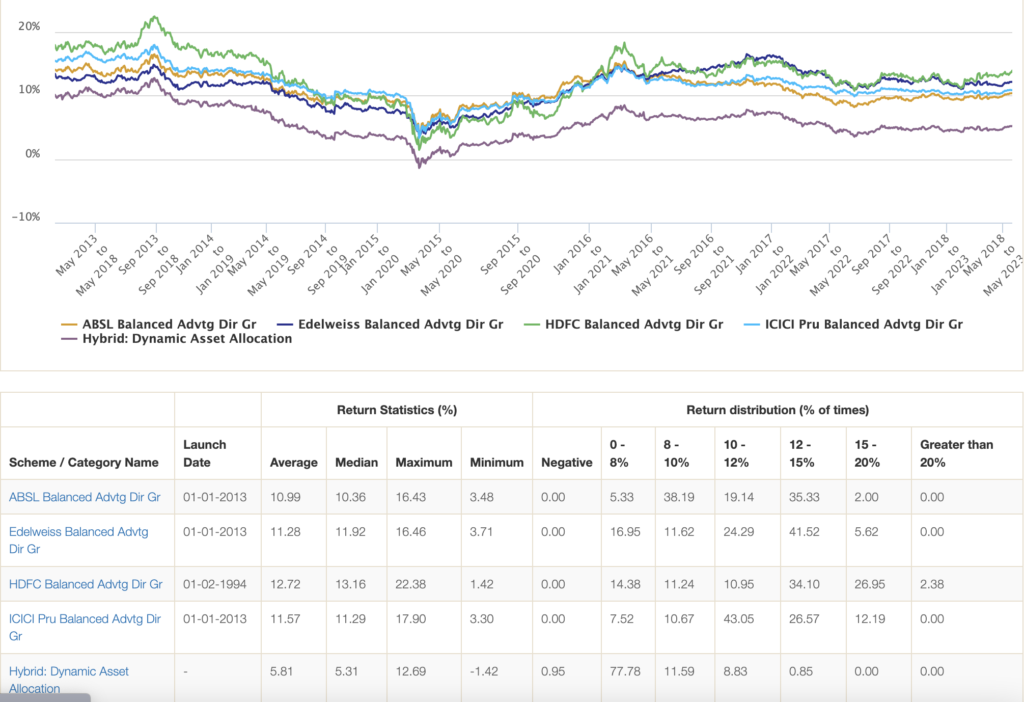

“I know Vikram, you are wondering about the returns.“ Betaal spoke, “This is what most people are interested in. As you know by now Mutual Funds do not guarantee returns. If we look at past performance of Balanced Advantage funds, what we see is as follows.

If you just go by past performance, then this chart is sufficient for you to make your own decision. But otherwise, please listen to me carefully”

What to look out while investing in Balanced Advantage Funds

One needs to check out few things before investing in these funds.

Style / Philosophy of investment

One needs to understand how fund moves allocation between Equity and Debt and should be comfortable with approach – Valuation or Mementum. That is starting point for selection of right fund for you.

In momentum style, you don’t have many funds in India to select from. Only Edelweiss.

In valuation category, one needs to have some understanding of what are parameters used to calculate market valuation. Investor or his/her financial planner should select appropriate fund that suits investor.

Asset Quality

One needs to look at Equity as well as Debt assets that fund invests in. Major returns are from Equity class. Unless Fund manager is able to pick proper stocks, just dynamic allocation will not help.

Some funds have exposure to low quality Debt papers to get higher returns. Others stick to only high quality debt papers even if returns are little less. Investors generally do not pay attention to this aspect and go with fund that has better past performance. Until event Franklin Templeteon Fiasco happens.

Betaal continues with his story. “If you are listening carefully till now, you would understand these funds fluctuate less than pure equity funds. Returns however also are generally 2-3% less than pure equity funds. So who should invest in them?

Investor Maturity

Investing in these funds needs certain maturity. One should be aware momentum type fund would do better in bull run. Valuation philosophy likely to prevail better in a market crash & recovery. In range bound market, it really depends on valuation of market.

Investors should avoid comparing your short term returns to your friend’s returns without understanding nature of your fund vis a vis others.

Risk Profile

Balanced Advantage Mutual Funds are right for first timer equity investors with balanced risk profile. Investors who are yet to see and handle volatility of stock markets. Since Equity exposure is not small in these funds, this category is not suitable for low risk profile clients.

For seasoned equity investor, this category can help in getting descent returns in situations like retirement period. If one has risk capacity, these funds can give descent 2% more returns compared to debt funds with some downside protection.

Part of their portfolio can be invested in this category. But of course, they need to do proper risk profiling with their financial planners to check suitability.

Due to inherent nature of equity, these funds should be invested with time horizon of 5 years or more.

Taxation of Balanced Advantage Mutual Funds

“Let me now talk about Tax. As a King, you must be wondering how much money would come to you as taxes.“ said Betaal, “As per law of land, any mutual fund, investing in Indian Stocks with average allocation of 65% or more is treated like Equity fund and remaining are treated like debt funds.

In case of Balanced Advantage Funds, fund manager can take equity allocation very low. However most of fund managers and fund houses are smart. They use equity derivatives to fill the gap of 65% mandate for taxation.

So although pure equity allocation may be low, most of them qualify for Equity taxation. That is 10% of LTCG on profit above 1 Lac if held more than a year.

However do check out respective fund to get confirmation on taxation.”

Which Balanced Advantage Mutual Fund is right for you

“So you must be wondering which fund to invest in“, Betaal said in low voice as if he is revealing some secret and did not want anyone else to listen. “Let us look at few of the funds that are noteworthy. I will give you my insights into them so you can decide for yourself.

ICICI Prudential Balanced Advantage Fund

The pioneer of Balanced Advantage Fund Category. has long track record. Based on valuation approach. It moves between equity and debt allocation by using an in-house model primarily based on the price-to-book value (P/BV) ratio. Model keeps getting upgraded as fund evolved. Experience fund manager. Debt papers are not of top quality but helps get that little extra returns. The fund also looks at other metrics and factors, including interest rate movements and global financial conditions. Current 5 year returns are in range of 12.5% but fund should do well in case of corrections.

Edelweiss Balanced Advantage Fund

This fund is suitable for you if momentum approach suits you. It will take very high equity exposure during bull run. So recent performance is good due to bull run. Fund has high quality Debt papers. Almost 15% returns for last five years. Held on extremely well during recent crash during corona crisis. Uses its proprietary sentiment index for deciding equity & debt allocation.

HDFC Balanced Advantage Fund

The big guy in Balanced Advantage Fund category with maximum asset under management. Very consistent fund with best performance over last 5 years. Though fund falls in Balanced Advantage category, generally equity allocation does not go below 65%. It plays in 65-80% range. That is reason for better reason but also for higher volatility. Fund style trends more towards aggressive hybrid equity fund rather than balanced advantage funds. Suitable for high risk investors.

SBI Balanced Advantage Fund

New kid on the block launched on 31st Aug 2021. With brand name of SBI, they were able to get significant AUM even though well established funds were around. The scheme aims to follow a Three-tiered investment strategy: 1: Asset allocation will be decided using parameters such as Sentiment Indicator, Valuations, and Earnings Drivers. 2 : Quantitative framework to determine market cap allocation, style skewness – Value/ Growth/Quality and sector preference. 3 : Focus on portfolio in such a manner that alpha is generated through equity, while it aims for stability through debt. Overall they can do anything dynamically 🙂 So let’s wait and watch.

** returns as of 15th Oct 2021

Also would suggest to take direct plans of any Mutual Funds. There is around 0.5 to 1% better returns compared to regular plans as you save commission. I use Kuvera !”

Conclusion

“So tell me King Vikramaditya,” said Betaal. “Who should invest in Balanced Advantage Mutual Funds and which one?”

King Vikramaditya thought and then said, “Balanced Advantage funds deserve to be in some peoples portfolio. They are of course not suitable for everyone and every goal. These are suitable for investors looking for participating in equity but do not want to handle high volatility

They are less volatile than pure equity funds but even returns would be lesser compared to pure equity funds. So investor should be ready for same.

They need certain level of maturity to invest and hold. One should not worry about short term lower returns compared to peer as particular strategy may not work in short term. They are better suited for some investors who have fluctuating mind between equity and debt allocation. Its better to let it handled professionally.

I will suggest people to do their own research or consult their Financial Advisor before taking any decision. Even I consult cabinet of ministers for important matters especially of money.

I thank you for educating me on Balanced advantage Mutual Funds. Knowledge is worth sharing with my entire kingdom via WhatsApp, Facebook & Twitter.“

Betaal said, “You are absolutely right King. I must say you are really intelligent. But you spoke and I will go back to tree.”

Pingback: New Fund Offers (NFO) Review - TechNFinance

Pingback: Taxes on Mutual Funds in India - TechNFinance